Free spread chart for arbitrage

Build a spread chart in real-time and make decisions based on historical data.

About charts

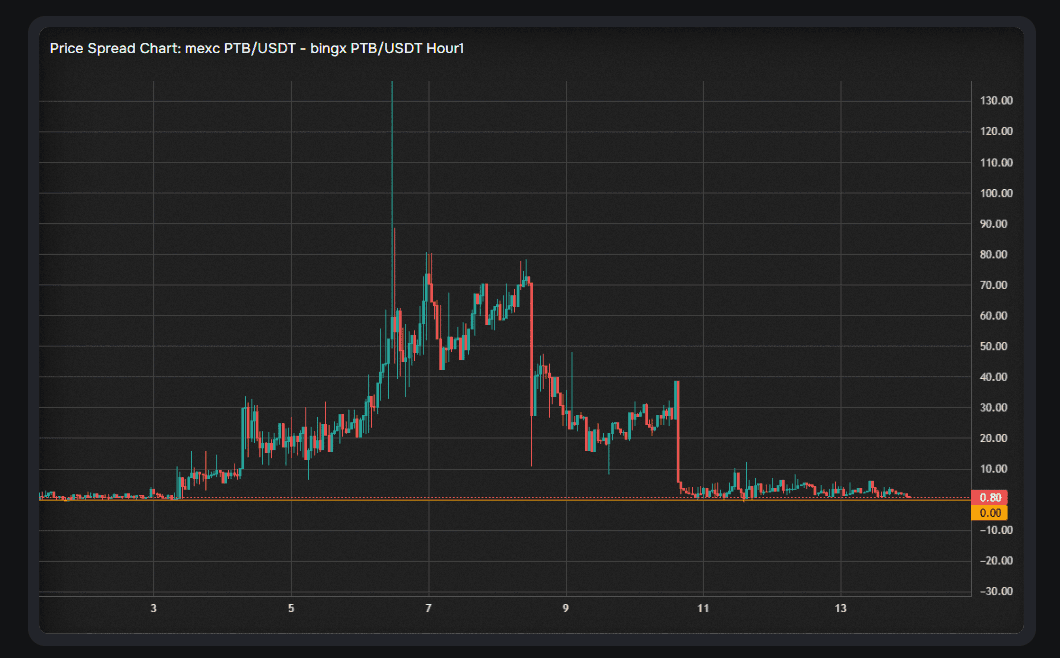

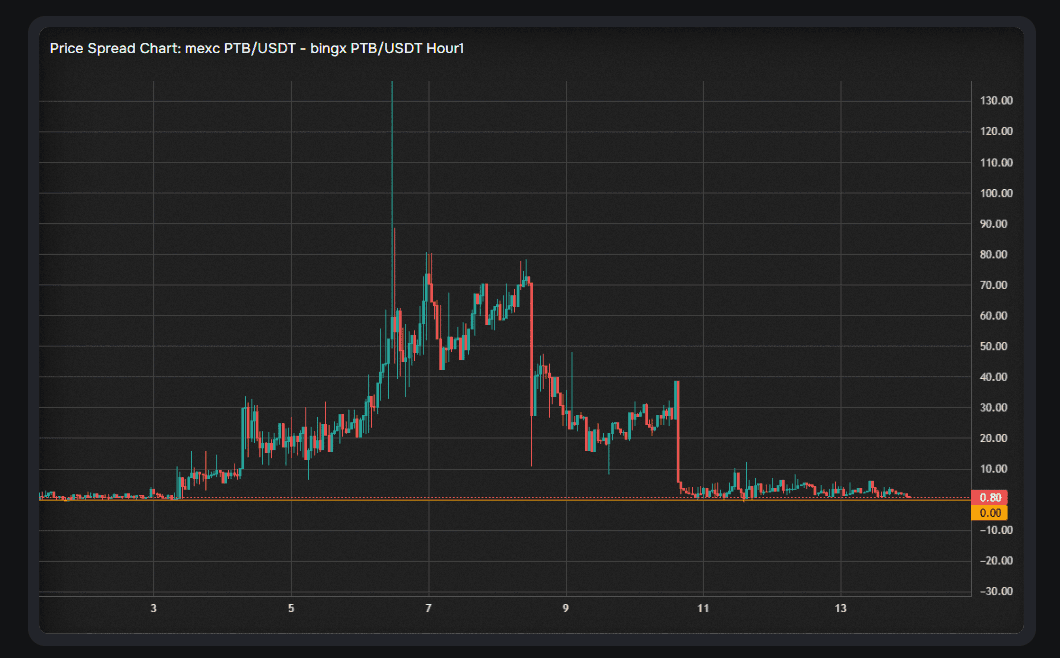

A spread chart is almost an essential tool for arbitrage. It is the first step in analyzing an arbitrage situation. Charts are especially useful for futures arbitrage traders.

The chart will show you how long ago the spread appeared, how large it was, and how it changed over time. You can also analyze price discrepancies in the recent past, if any, and make decisions based on this data.

How does the spread chart work?

A candlestick spread chart is a reconstruction of historical price data from different exchanges.

Each candle has a body and shadows. We know the exact start and end time of the candle (the candle body), so we can accurately determine the price at that moment for each exchange. The exact time of shadow formation is unknown to us.

We request candlestick price charts from two exchanges, compare prices at the start and end of the candle, calculate by what percentage the price on the second exchange was higher or lower than on the first, and build our own candles based on this information. We do the same with candle shadows. However, unlike bodies, we don't know the exact time of shadow formation and cannot be sure that shadows on two exchanges were formed at the same moment. Therefore, it's important to understand that shadows may display spread values with some error.

How to use the chart?

Using the chart is very simple. You need to select the trading pairs you're interested in by entering their names in the appropriate fields, specify the exchanges and asset type from the available list.

Next, our service will request historical data and build a spread chart based on it, then continue to receive data from these exchanges in real-time. This will allow you to immediately see price and spread changes without the need to manually refresh the page.

On the right side of the chart, you can see key information about the pair, such as: prices, price spread size, funding spread size, total spread size, and more.

How much does it cost to use the chart?

The spread chart is a completely free tool that you can use even without a subscription to our scanners for finding arbitrage pairs. You can use it by opening the corresponding page on our website and manually entering the names of tokens and exchanges you're interested in. However, for more convenient use, we recommend subscribing to our bots. A link to the chart with pre-filled data will be indicated directly in the message with pair information in our bot. You can open the chart directly in Telegram.